Which Benefit Model Best Suits Your Workforce’s Needs?

Scenario A: GP Coverage – Cost Savings Comparison

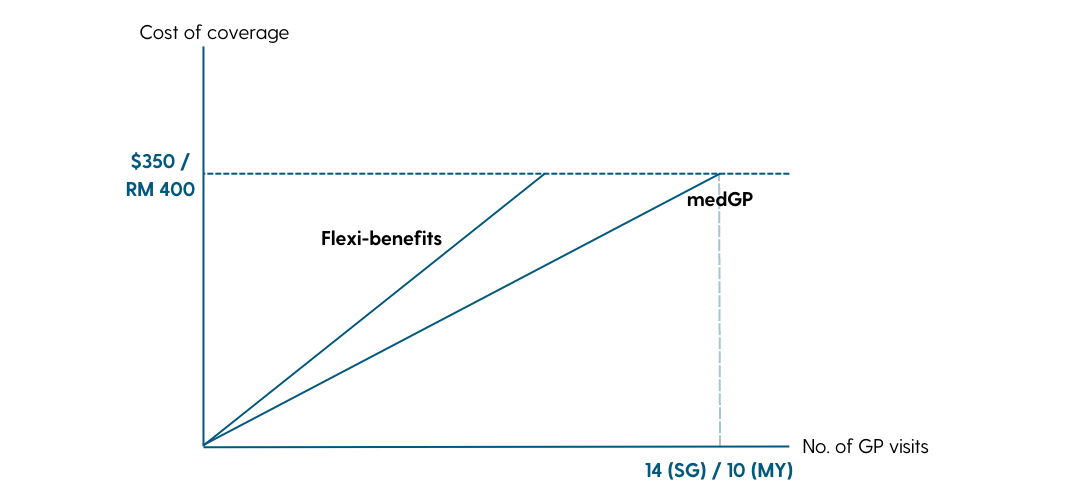

Company A, a company with more than 50 employees, averages around $350 per employee, per year on their GP coverage.

| Option 1: With medGP | Option 2: With medFlex |

|---|---|

| How it works: Pay $350 (flat-rate), employee can visit a GP clinic up to 14 times in a year. Benefits: - Cost predictability as yearly cost is fixed, helps to manage your healthcare budget more effectively. - Eliminate administrative hassle with cashless process and automated tracking of GP claims. | How it works: Depending on the number of times an employee visits a GP clinic, each visit may cost differently. Some employees might end up spending the full $350 on GP visits, while some employees may use less than the $350 on GP visits. Benefits: - As this solution follows a pay-per-use model and is highly customisable, you are able to set capping limits (e.g. cap per visit or co-payment) to control employees' spend on GP visits. - Prevent over-utilisation because employees that have used up the full $350 will have to pay the balance out of pocket. |

Conclusion: For corporates with a good gauge on past GP usage and want to prioritise cost savings, medGP offers a more predictable and potentially cheaper solution due to the fixed yearly rate.

Scenario B: Offering Diverse Benefits – Customisation Comparison

Company B, a growing company with more than 200 employees with diverse healthcare needs, wants to offer a broader range of benefits beyond GP coverage and has a budget of $800 per employee per year.

| Option 1: With medGP + medFlex | Option 2: With medFlex only |

|---|---|

| How it works: medGP covers GP visits for all employees at a flat yearly fee of $350. With the additional flexible benefits option, corporates can allocate the remainder $450 on flexible benefits like dental and optical care. Benefits: - Ensures more than sufficient GP care throughout the year for every employee. - Cost predictability on the GP portion of their coverage. - Concurrently offer a wider range of benefits that caters to employees that prefer flex options | How it works: Allows the corporate to customise how it wants to allocate the whole $800 entitlement across several benefit categories like GP, Dental, Optical, Screening, Specialist & Wellness. Within the allocated budget, employees have the flexibility to spend on the benefits that matter to them most. Benefits: - As this solution is highly customisable , corporates can enjoy maximum flexibility with their flex benefits. - Promotes morale from choice as employees can decide where to spend their entitlement. |

Conclusion: If you want to offer essential GP coverage for all and empower employee choice with additional benefits, combining medGP and flexible benefits can be ideal as it also promotes cost predictability. However, if maximum flexibility is the primary concern, a full flexible benefits model could be a better option.

Want to learn more on our schemes?